Our Estate Planning Attorney Diaries

Table of ContentsEstate Planning Attorney - An OverviewExamine This Report about Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Get ThisRumored Buzz on Estate Planning Attorney

Your lawyer will certainly additionally assist you make your papers official, organizing for witnesses and notary public trademarks as necessary, so you don't need to bother with attempting to do that last action on your own - Estate Planning Attorney. Last, however not least, there is valuable tranquility of mind in developing a partnership with an estate planning lawyer that can be there for you later onPut simply, estate planning attorneys provide worth in numerous methods, much past just providing you with printed wills, trust funds, or various other estate intending records. If you have questions regarding the procedure and wish to discover more, contact our office today.

An estate planning lawyer aids you formalize end-of-life choices and lawful documents. They can establish wills, develop counts on, produce health and wellness treatment instructions, develop power of lawyer, create succession plans, and much more, according to your wishes. Functioning with an estate preparation lawyer to complete and oversee this lawful documents can assist you in the complying with eight areas: Estate preparing attorneys are experts in your state's depend on, probate, and tax obligation regulations.

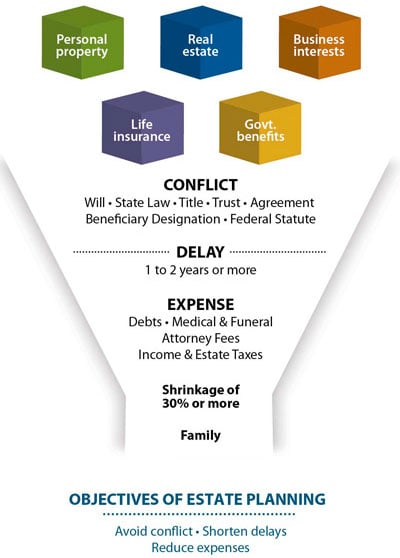

If you do not have a will, the state can decide exactly how to separate your assets amongst your heirs, which might not be according to your wishes. An estate planning attorney can help arrange all your legal papers and disperse your properties as you desire, possibly staying clear of probate.

Not known Details About Estate Planning Attorney

When a client passes away, an estate strategy would determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these decisions might be delegated the next of kin or the state. Tasks of estate organizers include: Producing a last will and testament Establishing trust fund accounts Naming an administrator and power of lawyers Determining all recipients Naming a guardian for minor youngsters Paying all financial debts and decreasing all tax obligations and legal costs Crafting directions for passing your values Developing choices for funeral arrangements Finalizing guidelines for care if you come to be sick and are unable to make choices Getting life insurance policy, handicap income insurance, and lasting care insurance An excellent estate strategy should be updated regularly as customers' economic circumstances, personal motivations, and government and state legislations all evolve

Just like any career, there are qualities and abilities that can help you achieve these goals as you collaborate with your customers in an estate coordinator function. An estate planning occupation can be right for you if you have the Recommended Reading adhering to qualities: Being an estate organizer means assuming in the lengthy term.

The Greatest Guide To Estate Planning Attorney

You have to assist your customer expect his or her see this site end of life and what will certainly happen postmortem, while at the same time not residence on morbid ideas or emotions. Some customers may become bitter or anxious when considering fatality and it could fall to you to assist them via it.

In the occasion of fatality, you may be anticipated to have countless conversations and dealings with making it through relative about the estate strategy. In order to succeed as an estate coordinator, you might require to stroll a fine line of being a shoulder to lean on and the individual depended on to communicate estate planning issues in a prompt and professional way.

tax obligation code transformed thousands of times in the ten years between 2001 and 2012. Expect that it has been changed better ever since. Relying on your customer's monetary earnings brace, which may evolve towards end-of-life, you as an estate organizer will need to keep your customer's possessions in full legal conformity with any regional, federal, or worldwide tax obligation regulations.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Getting this accreditation from companies like the National Institute of Certified Estate Planners, Inc. can be a solid differentiator. Belonging to these expert teams can confirm your abilities, making you more attractive in the eyes of a possible client. In enhancement to the psychological benefit of aiding customers with end-of-life planning, estate organizers appreciate the advantages of a steady revenue.

Estate planning is an intelligent point to do despite your existing health and monetary standing. Nonetheless, not numerous individuals understand where to begin the process. The first vital point is to employ an estate planning attorney to assist you with it. The complying with are five benefits of collaborating with an estate preparation lawyer.

The percentage of people who do not recognize how to get a will has increased from 4% to 7.6% because 2017. A seasoned lawyer knows what details to consist of in the will, including your recipients and unique factors to consider. A will certainly shields your family members from loss due to the fact that of immaturity or incompetency. It also gives the swiftest and most reliable method to transfer your properties to your beneficiaries.